Are you looking for investment in bonds in India? If yes, then you must have heard the name Wint Wealth, a popular app for bond investment in India. However, some retail investors question: Is Wint Wealth safe and legit to invest in bonds?

To answer all the questions of investors, we have curated this detailed blog post in the Wint Wealth review that will help you understand the platform, its working, legitimacy, and whether it is really safe and sound for investment in bonds or not.

So, without wasting any more time, let us get started.

What is Wint Wealth?

Wint Wealth is a bond investment app in India that was started in 2020 by Ajinkya Kulkarni, Abhik Patel, Shashank Chimaldari, and Anshul Gupta. The aim of the company was to help investors find easy ways to invest in fixed-income assets like corporate bonds and government bonds, which offer 9% to 12% returns.

The core goal of Wint Wealth is to enable investors and people in India to earn passive income and get better returns on their investment as compared to FD returns.

A common theme in most of the Wint Wealth review articles highlights its user-friendly interface, transparent pricing, easy-to-use features, quick KYC process, and loads of finance-related educational resources that help users learn and improve their financial knowledge for investment purposes.

Many users appreciate the ease of use of the Wint Wealth application; however, some also fear and ask: Is Wint Wealth safe to use? This question arises in the mind of an investor because the company was newly started in 2020.

However, like any other investment app in India, a user should consider their own goals and risk tolerance level while using the platform or app. Overall, Wint Wealth aims to blend technology, finance, and guidance to help investors invest in fixed-income securities.

How Does Wint Wealth Work?

The Wint Wealth app works by allowing investors to invest in fixed-income asset classes like bonds and FDs with low minimums of around 1K or more, as per the capability and limit of the investor. It offers various collections of corporate, government, and NBFC bonds that are looking to raise money and, in return, offer interest to the investor.

Apart from bonds, Wint Wealth also allows investors to invest in high-return FDs from private and NBFC companies but with moderate risk. This allows investors to earn passive income without any hard work.

In short, Wint Wealth partners with NBFCs, creates a secure bond pool, offers easy digital investment in fixed-asset classes, and aligns interests by co-investing in bonds, making complex debt markets accessible to all.

Here’s a step-by-step process of how Wint Wealth works:

Loan generation: First, there will be a need for money generated by companies, NBFCs, or the government. These parties will collect money from investors, who are mostly retail investors, via a loan at a higher rate of interest. The loan is a type of debt that offers a fixed return to the investor. The loan is generated in the form of bonds.

Bond structuring: With Wint Wealth structure, the loan is converted into a bond and further divided into various categories on their app and website. Some are corporate bonds, government bonds, and NBFC-backed bonds, each having different maturity dates, rates of interest, and repayment methods. The sorting and listing of all these things are done by Wint Wealth on their app/website in a more organized format, making it easy for the retail investor to invest in debt instruments.

Investor access: Once the bonds are live on the Wint Wealth app, investors can glide through various types of bonds that are live. Each investor can pick bonds based on factors like high returns, low risk, ratings, reviews, and more. After they have finalized which bonds they would like to invest in, they can either invest via a lump sum amount or start a bond SIP.

Investment and Payout: After the investment in bonds, investors will start getting their interest income, which can either be monthly, quarterly, yearly, or at the time of maturity, along with the principal amount.

Maturity: At the time of maturity, the investor will get their principal amount after deducting TDS.

Wint Wealth Bonds Review

Now that you might have understood how Wint Wealth works, let us now understand and read a detailed review of the Wint Wealth app. This review section will cover an overview of the app, the registration process, KYC, bond details, and a little more.

How to get started with Wint Wealth?

The first thing you need to do is download the Wint Wealth app on your iOS or Android phone. You can create your account on the web app and get started with your digital KYC.

Who Owns Wint Wealth?

Being an investor-backed startup, Wint Wealth is not owned by any one individual but a group of individuals and investors. It was started in the year 2020 by Ajinkya Kulkarni, Abhik Patel, Shashank Chimaladari, and Anshul Gupta, originally launched as GrowFix before rebranding to Wint Wealth. The company works and operates under Fourdegreewater Capital Private Limited and is based in Bangalore, India. Ajinkya Kulkarni serves as the founder and CEO of the company.

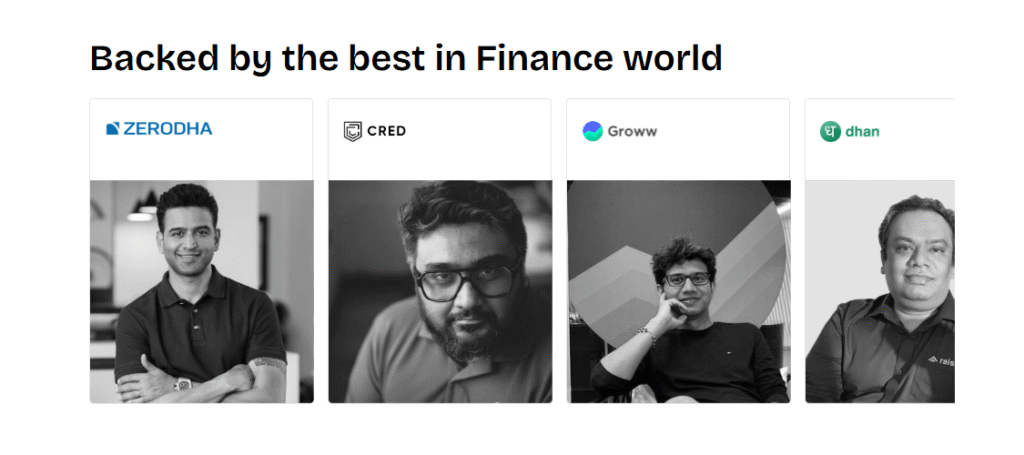

Besides, Wint Wealth has also received funds and investments from Eight Roads Ventures, 3one4 Capital, Arkam Ventures, Blume Ventures, and prominent angels such as Zerodha’s Nitin Kamath and CRED’s Kunal Shah.

This clearly means Wint Wealth is 100% safe and legit to use. However, one should note that investments under all the schemes are subject to risks associated with the market. Though bonds and FDs on Wint Wealth offer fixed income and returns, one should always make investments in these securities based on their knowledge and research.

What is the Use of Wint Wealth?

1. Investment in fixed-income securities

If you are reading this article on the Wint Wealth review, then one of the first uses of Wint Wealth is to use the app to invest in fixed-income earning securities like corporate bonds, government bonds, and FDs.

Unlike rigid bank FDs, Wint Wealth has curated a list of bonds, each having a different category and maturity time ranging from 1 year to 5 years, delivering good returns. Investors can choose from high credit, government, corporate, high-rated, high-return, or NBFC-backed bonds.

Based on our personal experience, we are getting a return of 10% p.a. on investment in bonds. So, if you are someone who is looking to make passive income, Wint Wealth is the place to be.

2. Passive income

Passive income is another highlight of this Wint Wealth review. The platform helps users invest in bonds through which they can earn regular interest payments either monthly, quarterly, or yearly. Since this is a new platform and started just in 2020, it raises a question among users: Is Wint Wealth safe for long-term passive income?

Since Wint Wealth focuses on helping investors earn a fixed income by investing in asset-backed instruments, it offers predictable cash flows, making it suited for salaried professionals who lack the knowledge to invest directly in the share market.

Unlike other high-risk passive income methods, Wint Wealth focuses on stability, transparency, and safety over aggressive returns. The platform’s structured products and clear payout terms make passive income more reliable and easy for users to manage.

3. FDs

In this Wint Wealth review, many of you might think Wint Wealth is a traditional platform for investing in FDs. However, this is not true.

Wint Wealth offers a slightly different type of FDs which offer higher returns as compared to traditional FDs, while maintaining the same risk profile. This again leads to a question among new users: “Is Wint Wealth safe to invest?”

While FDs are backed by banks, Wint Wealth focuses on secured investments backed by physical assets, offering more transparency and diversification beyond banks.

If you invest your money in a traditional bank FD, your money would be locked in for certain years at a rate of interest which will not be more than 7%.

At Wint Wealth, you will get FDs giving a rate of interest of 10% with no lock-in period. In fact, the platform also allows users to diversify and invest in multiple different FDs, each offering a different interest rate and lock-in period.

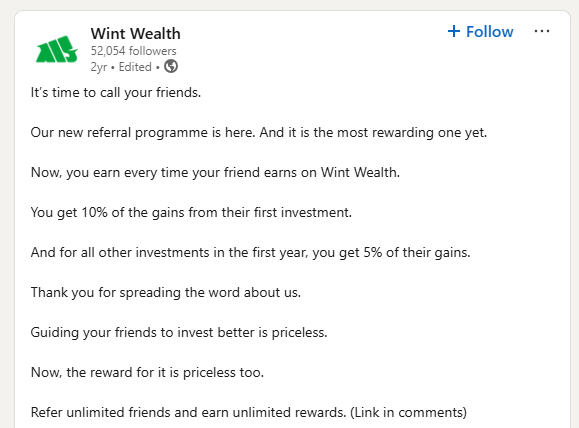

4. Refer and earn for extra income

Now here comes our personal favourite part of this Wint Wealth review. With Wint Wealth, you can earn extra passive income apart from your interest income from bonds and FDs.

Wint Wealth has a high-paying affiliate program in India through which you can earn almost INR 25,000. In this program, you can refer up to 5 new users who can be your friends, family members, or colleagues.

For each successful referral, Wint Wealth gives you Rs 5,000. That’s not all. Wint Wealth also pays a certain percentage of your referral earnings. This creates a secondary income stream without requiring additional capital investment.

5. Learning and earning

Another major benefit that we would love to highlight in this Wint Wealth review article is the learning opportunity available on the platform via its arm, Wint Capital.

Wint Capital is a place where you can learn anything related to finance, keep an eye on industry trends, get money-related advice, and more. Also, you can get B2B loans to meet the diverse financial needs of businesses across the nation.

The mission of Wint Capital is to democratize financial access by providing seamless loan products and services that will help businesses to thrive in the future.

So, if you are someone who is looking for a business loan or wants to improve your knowledge regarding finance, you should use Wint Capital.

Is Wint Wealth Safe?

When evaluating digital investment platforms, safety is the top concern of the majority of investors, and many of them ask if Wint Wealth is safe to use and invest in. When evaluating digital investment platforms, safety is the top concern of the majority of investors, and many of them ask if Wint Wealth is safe to use and invest in.

Wint Wealth positions itself as a platform where investors can invest in fixed-income asset-backed securities. Unlike other stock and demat account trading apps, it focuses on capital protection, transparency, and regulatory alignment.

1. Regulated by SEBI

If you visit the home page of Wint Wealth, you will see they have clearly mentioned that they are a SEBI-registered online bond platform provider, meaning they are fully regulated by the Securities Exchange Board of India to offer bonds, fixed-income securities, and other debt instruments to investors who are looking to make fixed income from their investment and want to play safe in the money market.

You can also verify their registration number INZ000313632 on the official website of SEBI and be assured that all your investments made on Wint Wealth will be safe and secure. This adds a layer of protection and gives confidence to investors who are asking: Is Wint Wealth safe?

2. Backed by investors

Another major reason to believe Wint Wealth is safe to invest in is its strong backing from reputed investors, both national and international. To date, the platform has raised funding from top angel investors in India and venture capital firms that conduct extensive due diligence before investing in any startup or business.

This backing from investors proves that Wint Wealth is 100% safe and sound to use. Support from investors not only offers financial stability but also adds a badge of credibility to the platform and encourages better governance, transparency, and long-term sustainability of the business.

3. We are personally using it

Many users often ask if Wint Wealth is safe and legit. We can surely say that yes, it is safe to use, as we have been personally using it for years and have invested a certain amount in bonds.

We felt it was a good way to make some passive income. From our personal experience, the onboarding and KYC process is very simple and easy.

Investors need to have a bank account, an Aadhaar card, and PAN card details with them to get started on Wint Wealth. Once verification is done, users will find the dashboard very intuitive, with a great user experience, and it reflects professionalism. Support is amazing too.

While investing platforms involve risk, Wint Wealth goes an extra mile to support the interests of investors and gives them assurance that all their investments are safe with them.

4. 17 lakh+ users till date

Wint Wealth has a strong and growing user base of more than 17 lakh users, which is a strong indication when assessing whether Wint Wealth is safe and legit. With such a massive user base, Wint Wealth has gained the trust of users and other investors who want to invest in fixed-income-backed securities.

Platforms that lack safety won’t be able to scale at this level. A growing user base means people have confidence in the platform. While popularity does not guarantee safety, it strongly suggests the platform is safe to use and legitimate.

5. Secure website and application

Security of the website and application plays an important role when answering questions like: Is Wint Wealth legit and safe to use? Wint Wealth uses HTTPS protocol on the website and application, which ensures 100% data encryption to safeguard users’ data, personal information, and transactions made via their platform.

Besides, they also follow two-factor authentication, which adds more security and gives confidence to users to use and invest through their platform.

6. Legit company profile

For anyone questioning whether Wint Wealth is safe, its legitimate company profile adds reassurance. Wint Wealth is a registered Indian fintech company with a clear leadership team, documented business operations, and transparent legal disclosures. It operates openly within India’s financial ecosystem and follows compliance norms expected of investment platforms. A visible corporate structure reduces the risks associated with anonymous or fly-by-night financial apps.

7. Social media presence

A consistent and active social media presence strengthens trust when asking whether Wint Wealth is safe. Wint Wealth maintains verified profiles across platforms like LinkedIn, Twitter, and Instagram, where it shares educational content, company updates, and user engagement posts. This transparency allows users to track announcements, policy changes, and community feedback. Active communication and public accountability are positive signs of a trustworthy and safe investment platform.

Is Wint Wealth RBI Regulated and Registered?

1. The Two Faces of Regulation

Wint Wealth isn’t just one company; it operates through two distinct legal frameworks to ensure compliance:

Investment Side (SEBI): The platform where you buy bonds (Fourdegreewater Services Pvt. Ltd.) is a SEBI-registered Stock Broker and Online Bond Platform Provider (OBPP). This ensures that the bonds you buy are listed, transparent, and settled through exchange-approved mechanisms.

Lending Side (RBI): The group also owns Ambium Finserve, which is an RBI-registered Non-Banking Financial Company (NBFC). This arm allows them to structure credit products and manage the debt side of the business under central bank oversight.

2. Why It Matters for You

Because Wint Wealth is regulated, your investments are held in your own Demat account (via NSDL/CDSL), not by the platform itself. This means even if the platform faces issues, your legal ownership of the bonds remains secure.

However, remember: while the platform is regulated, the risk lies in the bond issuer. Always check the credit rating of the specific bond before hitting “invest.”

FAQs of Wint Wealth Safe For Bond Investments

Yes, Wint Wealth is a SEBI-registered Online Bond Platform Provider (OBPP). While the platform is regulated and legitimate, the safety of your investment depends on the credit risk of the specific company issuing the bond. They primarily offer senior secured bonds, which are backed by collateral to reduce risk.

While Wint Wealth has had zero defaults to date, all corporate bonds carry a risk of default. If the issuing company goes bankrupt, your capital could be at risk. However, because they focus on secured bonds, investors have a higher claim on assets compared to unsecured creditors.

Wint Wealth typically offers yields between 9% and 11%, which is generally higher than traditional bank FDs. This higher return comes in exchange for higher credit risk and lower liquidity compared to a bank deposit.